Navigating the tumultuous waters of business taxes can feel like walking a tightrope without a safety net. For many entrepreneurs, the fear of unexpected tax liabilities looms large, often turning what should be a straightforward obligation into a nerve-wracking nightmare.

Whether youre a seasoned business owner or just stepping into the entrepreneurial arena, understanding how to deftly manage your tax responsibilities is crucial. A single misstep could lead to financial repercussions that may spiral out of control.

Fortunately, with a proactive approach and some savvy strategies, you can sidestep these pitfalls. In this article, we’ll explore essential tips that will empower you to stay compliant, minimize your tax burden, and maintain peace of mind, ensuring your focus remains where it should be—on growing your business.

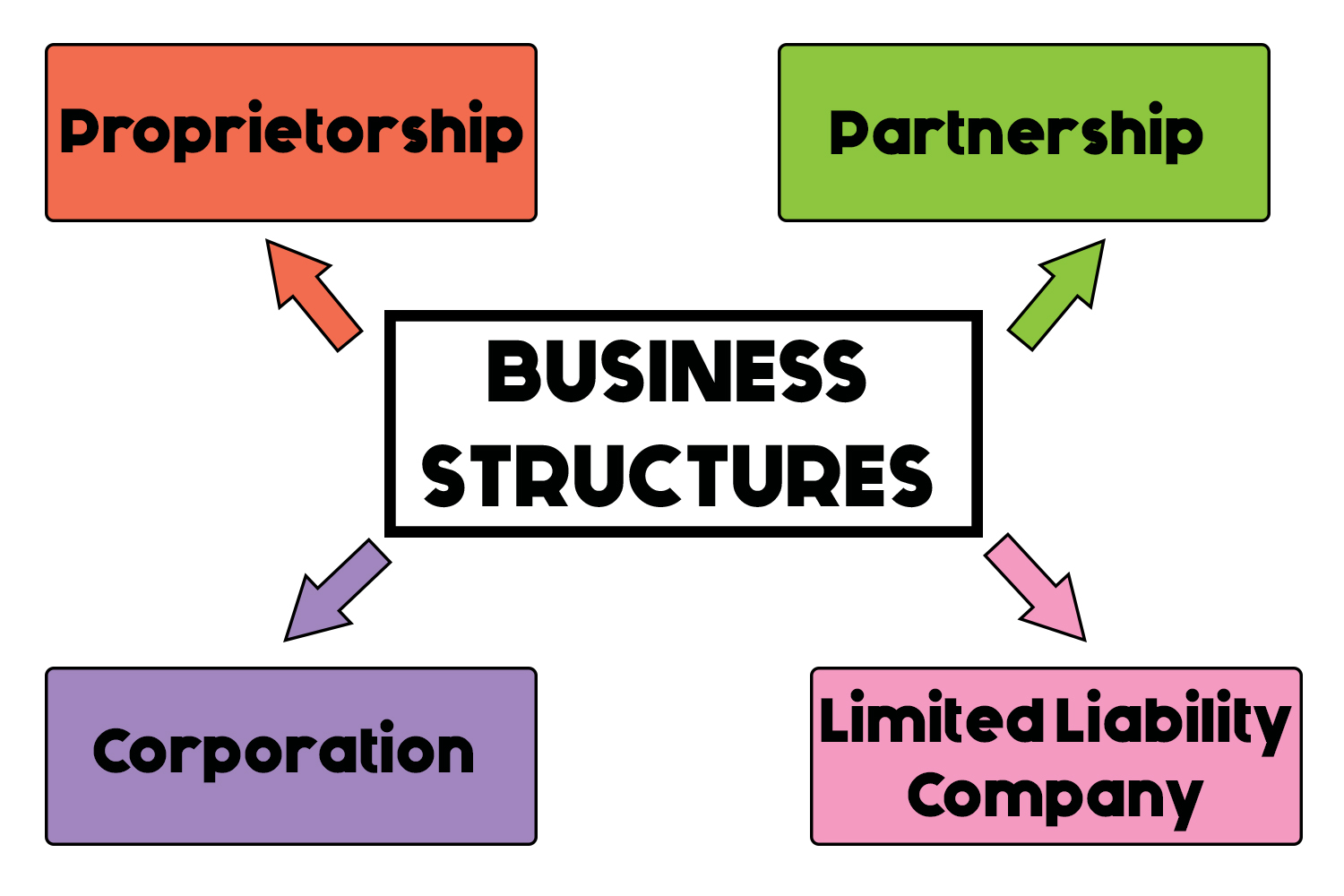

Choose the Right Business Structure

Choosing the right business structure is a pivotal decision that can significantly impact your tax obligations and overall financial health. As you stand at this crossroads, it’s essential to consider various options—sole proprietorships, partnerships, corporations, and limited liability companies (LLCs) all come with distinct advantages and responsibilities.

For instance, while an LLC offers personal liability protection, a sole proprietorship boasts a simpler tax filing process. However, that simplicity can come at a cost: without proper boundaries, your personal assets may be vulnerable.

Each structure creates a unique landscape of tax implications, from how profits are taxed to the possibilities of deducting expenses. It’s vital to scrutinize these nuances closely, for a misstep here could lead to unexpected tax surprises down the road.

So, take the time to consult with financial advisors or tax professionals to ensure you’re setting your business on a path that aligns with your long-term vision and minimizes your tax exposure.

Be Prepared for an Audit

When it comes to preparing for an audit, the key lies in diligence and foresight. Imagine receiving an unexpected notice from the IRS—panic might set in, but those savvy enough to stay organized can emerge unscathed.

Start by meticulously cataloging all financial documents: invoices, receipts, and tax returns should be readily accessible, almost like a well-prepared scout with their gear. Regularly reviewing your financial statements isn’t just a good practice; it’s essential.

This way, any inconsistencies can be nipped in the bud before they escalate into a nightmarish scenario. Additionally, investing in a robust accounting software or a trustworthy accountant can provide the extra cushion you might need.

Remember, audits may be daunting, but with a proactive approach, you can transform what seems like a terrifying experience into an opportunity for growth and clarity in your business practices.

Implement Secure Payment Processing Systems

Implementing secure payment processing systems is not just a best practice; its a crucial element in safeguarding your business and its financial integrity. With cyber threats lurking around every digital corner, entrepreneurs need to invest in robust payment gateways that encrypt sensitive data.

This means looking beyond basic transaction services and ensuring compliance with industry standards like PCI DSS. Additionally, choose options that offer features like tokenization and advanced fraud detection algorithms to enhance security further.

But it’s not just about technology; train your team on recognizing phishing attempts and other scams that could jeopardize customer trust and your bottom line. In this evolving landscape, a secure payment system is your first line of defense against tax nightmares linked to financial fraud, so don’t underestimate its importance.

Conclusion

In conclusion, navigating the complexities of business taxes doesnt have to be a daunting task for entrepreneurs. By staying organized, understanding tax obligations, and seeking professional guidance when needed, you can effectively avoid common tax pitfalls that lead to nightmares.

Implementing proactive strategies such as maintaining meticulous records, leveraging available deductions, and consulting with experts like Accountancy Capital can significantly ease the burden of tax season. Remember, being informed and prepared is your best defense against unexpected tax issues, allowing you to focus more on growing your business and achieving your entrepreneurial dreams.