In the world of trading, the allure of simulated environments often draws in both novice and experienced traders alike, promising a risk-free playground to refine strategies and hone skills. But as hypothetical gains pile up and markets respond predictably to well-intentioned trades, a nagging question lingers: Can these simulated victories truly translate into real-world success? While practice accounts provide a valuable rehearsal space, they come with inherent limitations—ranging from the absence of emotional stakes to the unpredictability of live markets.

As traders navigate this battlefield of uncertainty, it becomes crucial to dissect the dichotomy between virtual triumphs and the gritty reality of trading. This exploration sheds light on whether those pristine practice results can form a reliable foundation for actual trading endeavors, or if they merely serve as an alluring mirage, masking the complexities of the financial world.

What is Simulated Trading?

Simulated trading, often referred to as paper trading, is a practice that allows traders to engage in the financial markets without risking real money. This method provides a risk-free environment where individuals can test their strategies, understand market dynamics, and refine their skills through virtual transactions mirroring real market conditions.

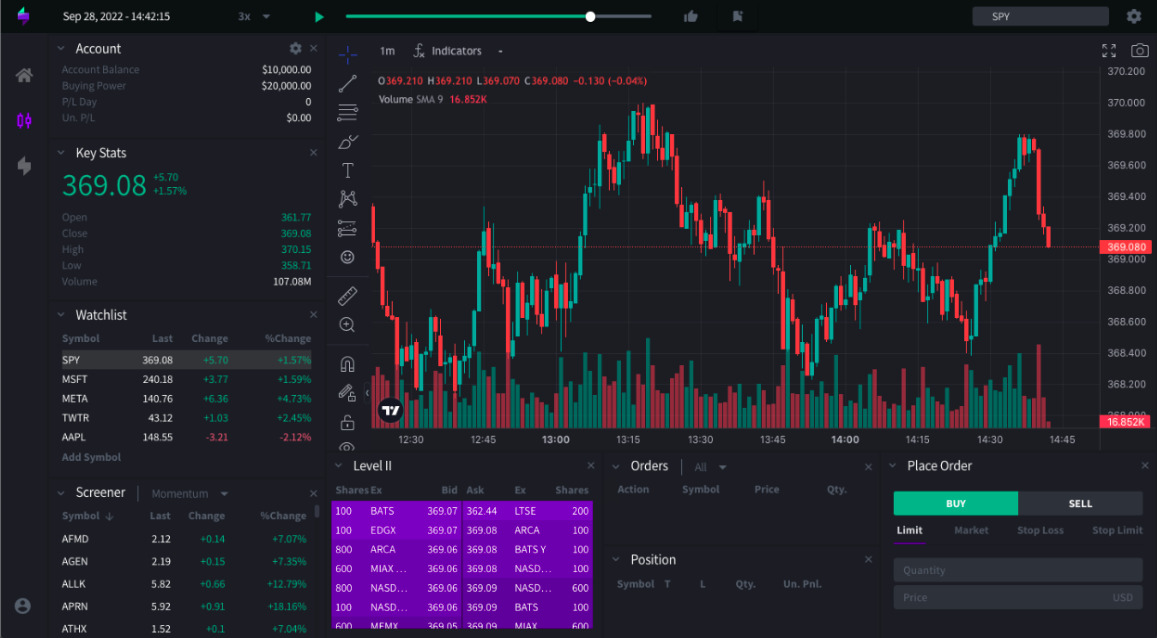

Advanced tools, such as depth of market software, further enhance this experience by providing detailed insights into order book data, enabling traders to analyze market liquidity and the balance of buyers versus sellers at various price levels. Imagine stepping into the bustling world of stock exchanges, but this time, the stakes are imaginary.

With real-time data and analytics at one’s fingertips, simulated trading can mirror genuine trading scenarios, yet it lacks the emotional highs and lows associated with actual trading. Thus, while it offers a safe playground for practice, the question looms: can it truly replicate the complexities and unpredictability of the real trading landscape?

Limitations of Simulated Trading

Simulated trading, while an invaluable tool for honing strategies and testing market reactions without financial risk, exhibits significant limitations that can skew the reliability of practice results. One major drawback is the absence of emotional factors; in a real trading environment, fear and greed can dramatically influence decision-making, often leading to actions starkly different from those taken in a controlled setting. Additionally, simulated platforms typically operate under ideal conditions—executions are swift, slippage is minimal, and liquidity is guaranteed.

This starkly contrasts with real-market scenarios where unexpected market events can create chaos, resulting in execution delays or worse-than-anticipated prices. Furthermore, traders may not encounter the same level of diversification or opportunity constraints as they would in genuine trading situations, leading to overconfidence in their simulated successes.

Thus, while simulated trading offers an essential practice ground, it is imperative for traders to approach their results with cautious optimism, recognizing that real-world trading is a far more unpredictable beast.

What is Real Trading?

Real trading refers to the actual buying and selling of financial instruments, where real money is at stake, and every decision can significantly impact ones financial well-being. Unlike simulated trading, which allows for practice without consequences, real trading immerses individuals in the dynamic world of markets where emotions run high, and risks are palpable.

The thrill of seeing investment flourish or falter is a visceral experience that simulated platforms simply cannot replicate. Each trade comes with its unique set of challenges, decision-making pressures, and the ever-looming presence of market volatility. In this high-stakes environment, traders must navigate not only technical analysis and strategies learned from simulations but also the unpredictable nature of human behavior and market sentiment.

Ultimately, real trading encapsulates a complex dance of strategy, psychology, and risk management that can either lead to success or teach harsh lessons.

Conclusion

In conclusion, while simulated trading offers valuable insights and an opportunity for traders to hone their skills without financial risk, it is essential to recognize the inherent limitations that come with it. The disparity between simulated and real trading can stem from factors such as market conditions, emotional responses, and the impact of real-world variables that are often absent in a controlled environment.

Tools like depth of market software can provide additional layers of understanding in live trading situations, further emphasizing the complex dynamics that traders must navigate in the real world. Ultimately, while practice results can bolster confidence and strategy formulation, they should not be solely relied upon as a predictor of future trading success; a balanced approach that combines simulation with real-world experience is crucial for developing a well-rounded trading competency.